This is the second in a three-part series devoted to conservation compliance. The first post introduced the conservation compliance sections of the farm bill and explained why they are critical to soil and water quality.

This post explains how USDA’s implementation of conservation compliance lacks effective enforcement and transparency.

Conservation Requirements

Under conservation compliance farmers whose land includes highly erodible land (HEL) as determined by the Natural Resources Conservation Service (NRCS), or that contains a wetland, must comply with conservation provisions to maintain eligibility for farm bill benefits. These benefits include crop insurance subsidies and USDAs commodities, credit and voluntary conservation programs.

Farmers with HEL must develop and comply with an NRCS approved conservation plan. Generally, plans “involve relatively inexpensive management measures like no till planting, crop residue management, crop rotations, [or] cover crops.” These practices are intended to reduce soil erosion and improve soil health. Developing the conservation plan is a cooperative process between an NRCS soil conservationist and the farmer: the soil conservationist’s aim is to offer technical assistance to best accomplish production goals without degrading the soil.

For land designated as a wetland, farmers are generally prohibited from: (1) planting crops on converted wetlands; and (2) converting wetlands to make agriculture production possible. However, there are many exceptions. NRCS determines what land qualifies as a wetland and when a conversion has occurred.

Certification and Enforcement

For both HEL and wetlands, the Farm Service Agency (FSA) makes farm bill benefits eligibility decisions after NRCS makes technical determinations of non-compliance. Yet, for both requirements, farmers are considered in compliance when they submit a self-certification form. Arguably, the self-certification policy is a product of both the agriculture sector’s sentiment that environmental regulation is too intrusive, and USDA’s limited resources and will to effectively enforce environmental protection requirements.

Summary of Conservation Compliance Status Reviews

Although, NRCS does conduct random compliance reviews, the USDA Office of Inspector General (OIG) has repeatedly noted that NRCS and FSA demonstrate inconsistent and disjointed enforcement. In general, the OIG has found incongruent data sets between the agencies when making compliance and eligibility determinations. This led to the agencies apparently failing to conduct compliance reviews for at least 10 states in 2015.

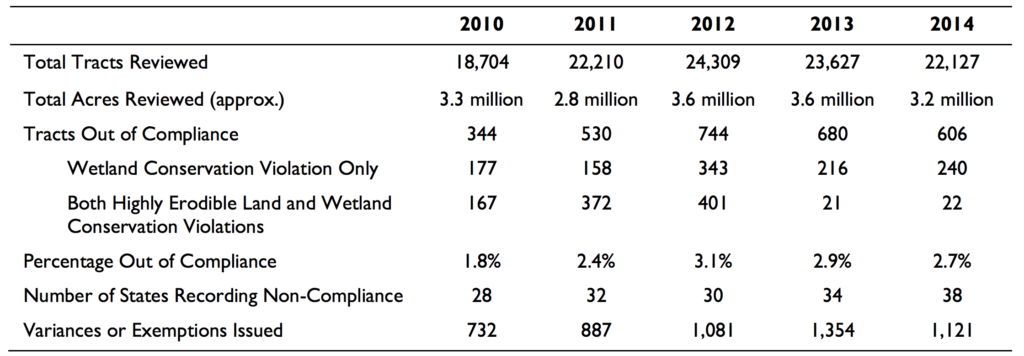

The OIG has also noted that few tracts of land are found non-compliant in comparison to the number of tracts reviewed. Further, many non-compliant land tracts remain eligible for USDA benefits. For instance, even when farmers are found non-compliant, FSA restores the majority of threatened farm bill benefits. In 2014 alone, FSA issued over one thousand variances or exemptions for land tracts after NRCS determined that they were non-compliant.

Enforcement Reporting Requirements

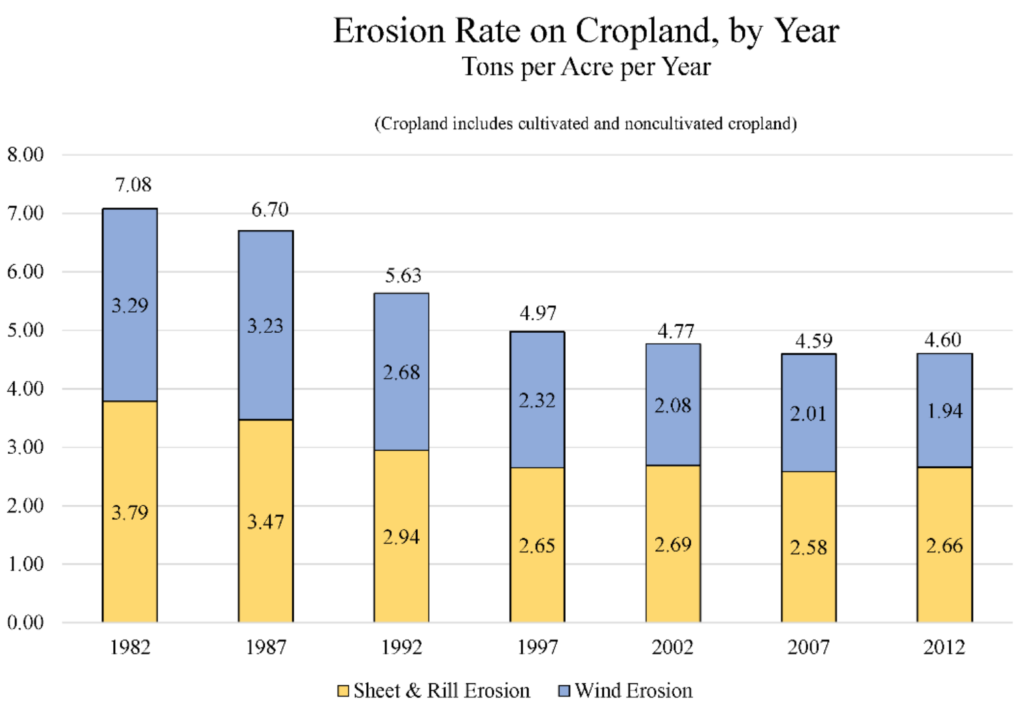

At the end of the day, enforcement is critical to ensure that tax-payer dollars are well-spent to accomplish public goals that include improved soil and water quality that underpin a resilient food system. Poor enforcement has undermined these conservation goals. As a recent USDA report illustrated, soil erosion rates on cultivated crop land have remained mostly unchanged since 1997. Within the last five years, however, overall erosion rates have actually increased slightly.

Unfortunately, Congress and the public remain unaware of the true scale of the problem because the current farm bill does not require USDA to report compliance or conservation results, just program enrollment data.

More transparent reporting requirements and coordinated interagency data collection would improve enforcement and, consequently, conservation results. After all, as the former Deputy Secretary, Jim Mosley, said, “Conservation compliance is a reasonable expectation of farmers who receive USDA benefits, including assistance for crop insurance premiums.”

Look out for the final post in this series, which will discuss the perennial debate regarding coupling and decoupling compliance and crop insurance benefits.